1099 r distribution code 4 in box 7 Use Code G in box 7. If the direct rollover is made on behalf of a nonspouse designated beneficiary, also enter Code 4 in box 7. For reporting instructions for a direct rollover from a . For sheet metal welding, welders will typically support flux-cored wires or solid wires as these give you the most control and versatility. The Reboot MIG welder supports both flux-cored and solid wires.

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · 1099 r minimum reporting amount

4 · 1099 r distribution codes 7d

5 · 1099 r distribution code meanings

6 · 1099 r code 7 means

7 · 1099 codes explained

SMART’s history includes the legacies of the Sheet Metal Workers’ International Association (SMWIA) and the United Transportation Union (UTU), two predecessor organizations that merged in January of 2008.

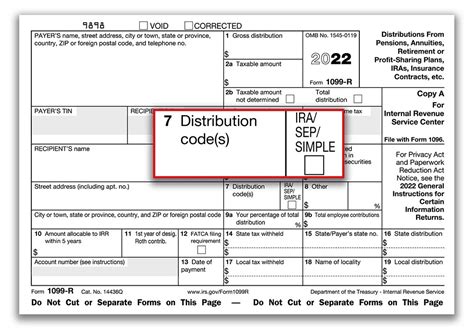

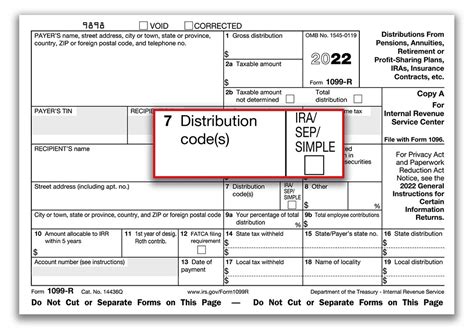

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

Use Code G in box 7. If the direct rollover is made on behalf of a nonspouse designated beneficiary, also enter Code 4 in box 7. For reporting instructions for a direct rollover from a .Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early . 2 (Early Distribution - not subject to 10% early distribution tax) 4 (Death) 7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code .

Code. Definition. 1. Early distribution, no known exception (in most cases, under age 59½). 2. Early distribution, exception applies (under age 59½). 3. Disability: 4. Death – regardless of .The following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned .

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Use Code G in box 7. If the direct rollover is made on behalf of a nonspouse designated beneficiary, also enter Code 4 in box 7. For reporting instructions for a direct rollover from a designated Roth account, see Designated Roth accounts, earlier.Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329; 2 (Early Distribution - not subject to 10% early distribution tax) 4 (Death) 7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution)

Code. Definition. 1. Early distribution, no known exception (in most cases, under age 59½). 2. Early distribution, exception applies (under age 59½). 3. Disability: 4. Death – regardless of the age of the employee/taxpayer to indicate to a decedent’s beneficiary, including an estate or trust.The following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned Income. if filing Form 4972 - Lump-Sum Distribution. box. report amounts in Box 3, Capital gain on Form 8949 as "Form 1099-R Charitable Gift Annuity." box. 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax returnThe code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

Use Code G in box 7. If the direct rollover is made on behalf of a nonspouse designated beneficiary, also enter Code 4 in box 7. For reporting instructions for a direct rollover from a designated Roth account, see Designated Roth accounts, earlier.Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329; 2 (Early Distribution - not subject to 10% early distribution tax) 4 (Death) 7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution)

Code. Definition. 1. Early distribution, no known exception (in most cases, under age 59½). 2. Early distribution, exception applies (under age 59½). 3. Disability: 4. Death – regardless of the age of the employee/taxpayer to indicate to a decedent’s beneficiary, including an estate or trust.

irs distribution code 7 meaning

The following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned Income. if filing Form 4972 - Lump-Sum Distribution. box. report amounts in Box 3, Capital gain on Form 8949 as "Form 1099-R Charitable Gift Annuity." box.

custom machining part pricelist

View how a metal roof will look on your home or building with Englert's metal roof design studio. Customize to your home and needs. Learn More.

1099 r distribution code 4 in box 7|irs 1099 box 7 codes