carnaud metal box pension scheme this was one of the largest transactions in the last 10 years and forms a blueprint for other large schemes looking to achieve similar objectives in the future See more $39.98

0 · metal box pension scheme case study

1 · metal box pension scheme buyout

2 · metal box pension scheme

In this case, you have to use a relay or a transistor so that the turn on wire from the head unit only biases the transistor or energizes the coil of the relay that will connect your .

this was one of the largest transactions in the last 10 years and forms a blueprint for other large schemes looking to achieve similar objectives in the future See moreThe Metal Box pension scheme completed a £2.2 billion all risks buyout with PIC. This marks the end of a truly strategic journey, which has lasted 11 years and has seen the scheme move from having a solvency funding level of 67% to a .PIC has signed a £2.2 billion pension insurance buy-in with the Trustee of the Metal Box Pension Scheme (the “Scheme”), guaranteeing the benefits of the Scheme's 10,300 pensioners and .With liabilities totalling £2.2bn, the Metal Box Pension Scheme buyout was one of the largest in the bulk annuity market over the last 10 years. The size of the deal, the tight timescales and .

Metal Box Pension Scheme has signed a £2.2bn (€2.6bn) buy-in with the Pensions Insurance Corporation (PIC) with the intention that this will move to a full buyout next month. .

The .2 billion pension plan for Carnaud Metalbox Group U.K., a subsidiary of Crown Cork & Seal, Philadelphia, dropped the CAPS Median index as its benchmark and . Metal Box Pension Insurance Corporation plc (“PIC”), a specialist insurer of defined benefit pension funds, has signed a £2.2 billion pension insurance buy-in with the Trustee of .

Pension Insurance Corporation (PIC), a specialist insurer of defined benefit pension funds, has signed a £2.2 billion pension insurance buy-in with the Trustee of the Metal Box . On the go: The Metal Box Pension Scheme has completed a full £2.2bn buy-in with Pension Insurance Corporation, with plans to convert this to a buyout in November 2021. The . Sackers is delighted to have advised the sponsor of the scheme, Crown Holdings on this £2.2bn buy-out transaction, the biggest bulk annuity deal of 2021 so far. The transaction . With liabilities totalling £2.2 billion, the Metal Box Pension Scheme ('the Scheme') buyout was one of the largest in the bulk annuity market over the last 10 years. The size of the deal, the tight timescales and the client’s focus on member outcomes led to the inclusion of a number of innovative features.

metal box pension scheme case study

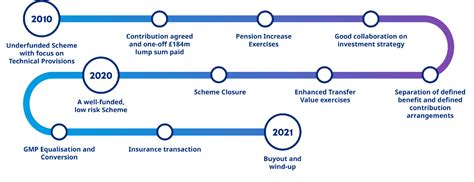

The Metal Box pension scheme completed a £2.2 billion all risks buyout with PIC. This marks the end of a truly strategic journey, which has lasted 11 years and has seen the scheme move from having a solvency funding level of 67% to a position where all member benefits have been secured with PIC.PIC has signed a £2.2 billion pension insurance buy-in with the Trustee of the Metal Box Pension Scheme (the “Scheme”), guaranteeing the benefits of the Scheme's 10,300 pensioners and 2,200 non-pensioner members.With liabilities totalling £2.2bn, the Metal Box Pension Scheme buyout was one of the largest in the bulk annuity market over the last 10 years. The size of the deal, the tight timescales and the client’s focus on member outcomes led to the inclusion of a number of innovative features.

Metal Box Pension Scheme has signed a £2.2bn (€2.6bn) buy-in with the Pensions Insurance Corporation (PIC) with the intention that this will move to a full buyout next month. The deal is the largest bulk annuity transaction of 2021, guaranteeing the benefits of the scheme’s 10,300 pensioners and 2,200 non-pensioner members. The .2 billion pension plan for Carnaud Metalbox Group U.K., a subsidiary of Crown Cork & Seal, Philadelphia, dropped the CAPS Median index as its benchmark and switched from balanced. Metal Box Pension Insurance Corporation plc (“PIC”), a specialist insurer of defined benefit pension funds, has signed a £2.2 billion pension insurance buy-in with the Trustee of the Metal Box Pension Scheme (the “Scheme”), guaranteeing the benefits of the Scheme’s 10,300 pensioners and 2,200 non-pensioner members. Pension Insurance Corporation (PIC), a specialist insurer of defined benefit pension funds, has signed a £2.2 billion pension insurance buy-in with the Trustee of the Metal Box Pension Scheme, guaranteeing the benefits of the scheme’s 10,300 pensioners and 2,200 non-pensioner members.

On the go: The Metal Box Pension Scheme has completed a full £2.2bn buy-in with Pension Insurance Corporation, with plans to convert this to a buyout in November 2021. The buy-in will guarantee the benefits of the scheme’s 10,300 pensioners and .

Sackers is delighted to have advised the sponsor of the scheme, Crown Holdings on this £2.2bn buy-out transaction, the biggest bulk annuity deal of 2021 so far. The transaction insures 12,500 pensioner and deferred members of the Metal Box Pensions Scheme with PIC.

With liabilities totalling £2.2 billion, the Metal Box Pension Scheme ('the Scheme') buyout was one of the largest in the bulk annuity market over the last 10 years. The size of the deal, the tight timescales and the client’s focus on member outcomes led to the inclusion of a number of innovative features.The Metal Box pension scheme completed a £2.2 billion all risks buyout with PIC. This marks the end of a truly strategic journey, which has lasted 11 years and has seen the scheme move from having a solvency funding level of 67% to a position where all member benefits have been secured with PIC.

sheet metal brake design

PIC has signed a £2.2 billion pension insurance buy-in with the Trustee of the Metal Box Pension Scheme (the “Scheme”), guaranteeing the benefits of the Scheme's 10,300 pensioners and 2,200 non-pensioner members.With liabilities totalling £2.2bn, the Metal Box Pension Scheme buyout was one of the largest in the bulk annuity market over the last 10 years. The size of the deal, the tight timescales and the client’s focus on member outcomes led to the inclusion of a number of innovative features. Metal Box Pension Scheme has signed a £2.2bn (€2.6bn) buy-in with the Pensions Insurance Corporation (PIC) with the intention that this will move to a full buyout next month. The deal is the largest bulk annuity transaction of 2021, guaranteeing the benefits of the scheme’s 10,300 pensioners and 2,200 non-pensioner members.

sheet metal brake 10

The .2 billion pension plan for Carnaud Metalbox Group U.K., a subsidiary of Crown Cork & Seal, Philadelphia, dropped the CAPS Median index as its benchmark and switched from balanced. Metal Box Pension Insurance Corporation plc (“PIC”), a specialist insurer of defined benefit pension funds, has signed a £2.2 billion pension insurance buy-in with the Trustee of the Metal Box Pension Scheme (the “Scheme”), guaranteeing the benefits of the Scheme’s 10,300 pensioners and 2,200 non-pensioner members. Pension Insurance Corporation (PIC), a specialist insurer of defined benefit pension funds, has signed a £2.2 billion pension insurance buy-in with the Trustee of the Metal Box Pension Scheme, guaranteeing the benefits of the scheme’s 10,300 pensioners and 2,200 non-pensioner members.

On the go: The Metal Box Pension Scheme has completed a full £2.2bn buy-in with Pension Insurance Corporation, with plans to convert this to a buyout in November 2021. The buy-in will guarantee the benefits of the scheme’s 10,300 pensioners and .

metal box pension scheme buyout

metal box pension scheme

Richconn employs state-of-the-art CNC machines, ensuring optimal precision in every step of the machining operation. Our commitment to technological advancement guarantees that your motorcycle parts are crafted with the utmost accuracy.

carnaud metal box pension scheme|metal box pension scheme case study