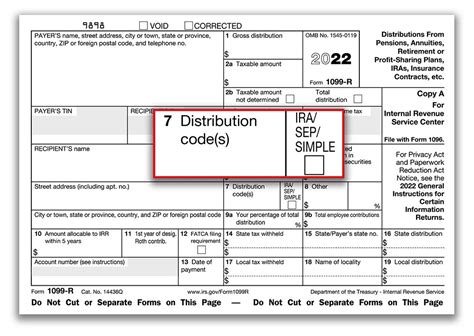

1099 r box 7 distribution code j If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7. What Role Do Rubber Bands Play in Underbite Correction? Rubber bands, also known as elastics, play a crucial role in underbite correction. They are attached to the brackets on the braces and help align the upper and lower teeth.

0 · roth ira code j taxable

1 · distribution code 7 normal

2 · distribution code 7 1099 r

3 · 1099r with code j

4 · 1099r box 7 code j

5 · 1099 r distribution codes meaning

6 · 1099 r distribution code j

7 · 1099 r code j taxable

Browse our products at https://www.sevilleclassics.com/ !0:00 Storage Cabinet Introduction0:10 TIP: Assemble the cabinet on the flattened cardboard box to pr.

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.Information about Form 1099-R, Distributions From Pensions, Annuities, .

Use Code J for a distribution from a Roth IRA when Code Q or Code T does not apply. Code J indicates that there was an early distribution from a ROTH IRA. The amount .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . Use Code Q for a distribution from a Roth IRA if you know that the participant meets .

Code J should be used if the Roth IRA owner meets the five-year waiting period but the distribution is not qualified because the IRA owner is not yet age 59½, has not died, or is not disabled. Use code J to report a qualified .1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 .

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.

Use Code J for a distribution from a Roth IRA when Code Q or Code T does not apply. Code J indicates that there was an early distribution from a ROTH IRA. The amount may or may not be taxable depending on the amount distributed and the taxpayer's basis in .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Use Code Q for a distribution from a Roth IRA if you know that the participant meets the 5-year holding period and: The participant has reached age 59 1/2, The participant died, or; The participant is disabled. Note: If any other code, such as 8 or P, applies, use Code J. None. R. Recharacterized IRA contribution made for 2017

Code J should be used if the Roth IRA owner meets the five-year waiting period but the distribution is not qualified because the IRA owner is not yet age 59½, has not died, or is not disabled. Use code J to report a qualified distribution for first-time homebuyer expenses.

1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).The following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned Income. if filing Form 4972 - Lump-Sum Distribution. box. report amounts in Box 3, Capital gain on Form 8949 as "Form 1099-R Charitable Gift Annuity." box.

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, . All of these corrections must include applicable earnings, these are included in the 1099-R amounts.. Code A: .

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7. Use Code J for a distribution from a Roth IRA when Code Q or Code T does not apply. Code J indicates that there was an early distribution from a ROTH IRA. The amount may or may not be taxable depending on the amount distributed and the taxpayer's basis in .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

Use Code Q for a distribution from a Roth IRA if you know that the participant meets the 5-year holding period and: The participant has reached age 59 1/2, The participant died, or; The participant is disabled. Note: If any other code, such as 8 or P, applies, use Code J. None. R. Recharacterized IRA contribution made for 2017

Code J should be used if the Roth IRA owner meets the five-year waiting period but the distribution is not qualified because the IRA owner is not yet age 59½, has not died, or is not disabled. Use code J to report a qualified distribution for first-time homebuyer expenses.

1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

The following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned Income. if filing Form 4972 - Lump-Sum Distribution. box. report amounts in Box 3, Capital gain on Form 8949 as "Form 1099-R Charitable Gift Annuity." box.

roth ira code j taxable

machined metal component fabrication

madison home usa box spring steel frame mattress

Uma fábrica produz 240 peças de metal, algumas delas medindo 30 e outras medindo 40centímetros. Sabendo que o comprimento total das peças produzidas é igual a 7600centímetros, quantas peças de 30 centímetros foram produzidas?04.

1099 r box 7 distribution code j|distribution code 7 1099 r