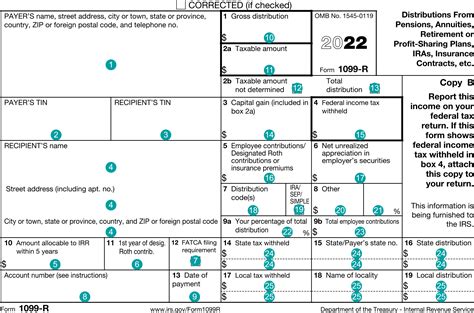

box 7 distribution code 2 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R .

The inverted black triangle (German: schwarzes Dreieck) was an identification badge used in Nazi concentration camps to mark prisoners designated asozial ("a(nti-)social") [1] [2] and arbeitsscheu ("work-shy"). The Roma and Sinti people were considered .A capacitor is a device that stores electric charge, and it typically consists of two parallel metal sheets known as plates. When these plates are connected to a battery, one plate accumulates a positive charge, while the other plate accumulates a negative charge.

0 · pension distribution codes

1 · irs roth distribution codes

2 · irs pension distribution codes

3 · ira normal distribution 7

4 · box 7 code 4

5 · box 7 1099 r

6 · 1099 r 7d distribution code

7 · 1099 box 7 code 6

You can tell the shape of the histogram (distribution) - in many cases at least - by just looking the box plot, and you can also estimate whether the mean is less than or greater than the median. Recall that the mean is impacted by especially large or small values, even if there are just a few of them, while the median is more stable with .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . Use Code 2 only if the participant has not reached age 59 1/2 and you know the .For a Roth IRA conversion, use Code 2 in box 7 if the participant is under age 59½ or Code 7 if the participant is at least age 59½. Also, check the IRA/SEP/SIMPLE checkbox in box 7. Code 2, Early distribution, exception applies, lets the IRS know that the individual is under age 59½ but that he or she qualifies for certain exceptions. the individual qualifies for a penalty tax exception that doesn’t .

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. Code Explanation Used with, ifapplicable . 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, . Code 2 is used when an early distribution is taken from a retirement plan or IRA, but an exception to the 10% early withdrawal penalty applies. This code is used to indicate a distribution from a retirement account .

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Code 7: Normal .Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding andThe code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Use Code 2 only if the participant has not reached age 59 1/2 and you know the distribution is: A Roth IRA conversion (an IRA converted to a Roth IRA). A distribution made from a qualified retirement plan or IRA because of an IRS levy under section 6331.

pension distribution codes

For a Roth IRA conversion, use Code 2 in box 7 if the participant is under age 59½ or Code 7 if the participant is at least age 59½. Also, check the IRA/SEP/SIMPLE checkbox in box 7.

Code 2, Early distribution, exception applies, lets the IRS know that the individual is under age 59½ but that he or she qualifies for certain exceptions. the individual qualifies for a penalty tax exception that doesn’t require using codes 1, 3, or 4.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. Code Explanation Used with, ifapplicable .

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax returnBox 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½). Code 2 is used when an early distribution is taken from a retirement plan or IRA, but an exception to the 10% early withdrawal penalty applies. This code is used to indicate a distribution from a retirement account due to the account owner's total and permanent disability. This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Code 7: Normal distribution. The distribution is after age 59 1/2. B (Designated .

irs roth distribution codes

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Use Code 2 only if the participant has not reached age 59 1/2 and you know the distribution is: A Roth IRA conversion (an IRA converted to a Roth IRA). A distribution made from a qualified retirement plan or IRA because of an IRS levy under section 6331.

oem cnc machining parts factory

For a Roth IRA conversion, use Code 2 in box 7 if the participant is under age 59½ or Code 7 if the participant is at least age 59½. Also, check the IRA/SEP/SIMPLE checkbox in box 7. Code 2, Early distribution, exception applies, lets the IRS know that the individual is under age 59½ but that he or she qualifies for certain exceptions. the individual qualifies for a penalty tax exception that doesn’t require using codes 1, 3, or 4.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. Code Explanation Used with, ifapplicable . 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax returnBox 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

Code 2 is used when an early distribution is taken from a retirement plan or IRA, but an exception to the 10% early withdrawal penalty applies. This code is used to indicate a distribution from a retirement account due to the account owner's total and permanent disability.

irs pension distribution codes

ira normal distribution 7

box 7 code 4

box 7 1099 r

Here are 12 of the most common types of CNC machines. Each performs somewhat different machining operations with few human errors, high-speed processes, and high-quality results. 1. CNC Milling Machine. CNC milling machines use rotating cutting tools to remove material from a workpiece.

box 7 distribution code 2|box 7 1099 r