1099-r distribution code for taxable amount in box 2a Beginning January 1, 2024, the automatic rollover amount has increased from . The 12ft Hexagon treehouse kit includes: * Qty 2 - 1.25” static brackets * Qty 8 - 3/8”x4” GRK rugged structural screw (for static brackets) * Qty 8 - 5/16”x6” GRK rugged structural screws (for the end of the boards sitting on the static .

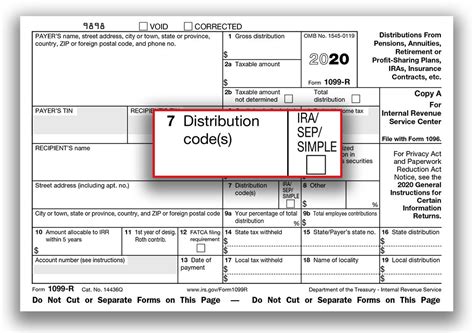

0 · irs 1099 r distribution codes

1 · ira distribution code 2

2 · form 1099 r distribution codes

3 · 1099r box 7 code 2

4 · 1099 r tax codes

5 · 1099 r distribution code p

6 · 1099 r code p

7 · 1099 code g

Flowable Extender is the medium-bodied clear acrylic base for Lumiere & Neopaque. Mix it into any other Lumiere and Neopaque color to create transparency without changing the consistency of the paint. For a transparent metallic shimmer, try adding some Pearl-Ex Powdered Pigments to the extender for use on fabric.

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).Information about Form 1099-R, Distributions From Pensions, Annuities, .Beginning January 1, 2024, the automatic rollover amount has increased from .If you see a 0 (zero) in Box 2a of your 1099-R paper form, the entire distribution amount in Box 1 is nontaxable. However, if Box 2a is blank (empty) on your 1099-R form, the taxable portion of .

Generally, the issuer of the 1099-R will have an amount listed in Box 2a for the taxable amount. If no amount is listed, you will need to determine the amount yourself. If this is a Roth . Box 2a - Taxable Amount shows the portion of the distribution that is generally taxable. If there is no entry in this box, the payer wasn't able to determine the taxable amount and it will have to be determined by the .

Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early .

If you see a ”0” (zero) in Box 2a of your 1099-R paper form, the entire distribution amount in Box 1 is nontaxable. However, if Box 2a is blank (empty) on your 1099-R form, the . The taxable amount in box 2a is usually the box 1 amount unless you have after-tax contributions in the retirement plan and use the simplified method. P (Taxable in a prior year of the 1099-R year – the year the refunded contribution was made) *Non-qualified Roth Distribution (less than 5 years) – use code B and complete . To qualify for inclusion, you must have received an amount equal to or greater than from any of the above distribution categories. Who Receives One? The IRS Form 1099-R .

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).If you see a 0 (zero) in Box 2a of your 1099-R paper form, the entire distribution amount in Box 1 is nontaxable. However, if Box 2a is blank (empty) on your 1099-R form, the taxable portion of your distribution needs to be calculated:Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding.Generally, the issuer of the 1099-R will have an amount listed in Box 2a for the taxable amount. If no amount is listed, you will need to determine the amount yourself. If this is a Roth Distribution that has been held for 5 or more years and you are withdrawing the .

Box 2a - Taxable Amount shows the portion of the distribution that is generally taxable. If there is no entry in this box, the payer wasn't able to determine the taxable amount and it will have to be determined by the taxpayer. When this occurs, the first box in .

Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early distribution tax. If you see a ”0” (zero) in Box 2a of your 1099-R paper form, the entire distribution amount in Box 1 is nontaxable. However, if Box 2a is blank (empty) on your 1099-R form, the taxable portion of your distribution needs to be calculated: The taxable amount in box 2a is usually the box 1 amount unless you have after-tax contributions in the retirement plan and use the simplified method. P (Taxable in a prior year of the 1099-R year – the year the refunded contribution was made) *Non-qualified Roth Distribution (less than 5 years) – use code B and complete Box 11 (Roth clock start), the principal Roth contribution amount in Box 10, and the taxable amount in Box 2A. DWC Notes: All hardships under the age of 59 1/2 must use .

To qualify for inclusion, you must have received an amount equal to or greater than from any of the above distribution categories. Who Receives One? The IRS Form 1099-R is most closely associated with retirees who regularly make withdrawals from their retirement accounts (e.g. IRAs or 401 (k)s) to fund their lifestyles in retirement.If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).If you see a 0 (zero) in Box 2a of your 1099-R paper form, the entire distribution amount in Box 1 is nontaxable. However, if Box 2a is blank (empty) on your 1099-R form, the taxable portion of your distribution needs to be calculated:Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding.

Generally, the issuer of the 1099-R will have an amount listed in Box 2a for the taxable amount. If no amount is listed, you will need to determine the amount yourself. If this is a Roth Distribution that has been held for 5 or more years and you are withdrawing the . Box 2a - Taxable Amount shows the portion of the distribution that is generally taxable. If there is no entry in this box, the payer wasn't able to determine the taxable amount and it will have to be determined by the taxpayer. When this occurs, the first box in .

Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early distribution tax.

If you see a ”0” (zero) in Box 2a of your 1099-R paper form, the entire distribution amount in Box 1 is nontaxable. However, if Box 2a is blank (empty) on your 1099-R form, the taxable portion of your distribution needs to be calculated:

The taxable amount in box 2a is usually the box 1 amount unless you have after-tax contributions in the retirement plan and use the simplified method.

P (Taxable in a prior year of the 1099-R year – the year the refunded contribution was made) *Non-qualified Roth Distribution (less than 5 years) – use code B and complete Box 11 (Roth clock start), the principal Roth contribution amount in Box 10, and the taxable amount in Box 2A. DWC Notes: All hardships under the age of 59 1/2 must use .

cutting hole in sheet metal

irs 1099 r distribution codes

ira distribution code 2

The TRINITY 66 in. x 19 in. Stainless Steel Rolling Workbench provides all your garage, basement, or kitchen storage needs. The drawer layout accommodates large and small tools, and the drawers have 100 lb. weight capacity ball .

1099-r distribution code for taxable amount in box 2a|1099 r code p