dreyfus why does 1099-r box 2b check total distribution If you are reporting a total distribution from a plan that includes a distribution of DVECs, you may file a separate Form 1099-R to report the distribution of DVECs. If you do, report the .

Printing CMYK, Lc, Lm, white ink and varnish, our UV printer for phone cases .

0 · rmd 1099 r total distribution

1 · form 1099 r distribution

2 · form 1099 r check box

3 · form 1099 r box 2b

4 · 1099 r total distribution

5 · 1099 r gross distribution

6 · 1099 r form box 3

7 · 1099 r distribution code

Choosing the Right Electrical Box for Your Project. Selecting the appropriate electrical box depends on several factors, including construction, wiring method, devices, location, and safety. Type of Construction. Your project’s construction type influences the choice of .Electrical boxes encase wire connections to protect them from short circuits. They are vital for fire safety and are used for receptacles, ceiling fans, outside outlets, and more. Unless the device is one of the few that contains its own wires, it likely will need an electrical box.

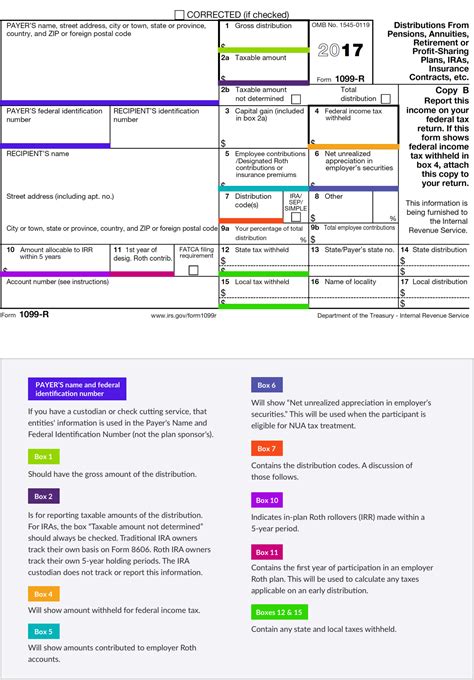

The 1099-R issued for the RMD and under his SSN shows this as a Total Distribution (ie. both boxes in 2b are checked). The RMD distribution shown on the 1099-R was not a total distribution that closed out his account. No, the Taxable amount not determined checkbox is entirely separate from the Total distribution checkbox. Box 2b contains two check boxes that provide information from the payer about the distribution. Taxable amount not determined - The payer was unable to determine the taxable amount, so it's up to the taxpayer to . My 1099-r has a distribution code 2b, but that is not an option in the pull down menu, how do I file that? Codes B and 2 together do not indicate a distribution from a Roth .

We have a number of clients who are being given 1099R's that have the Line 2b Total Distribution box checked, when in fact they did not receive a "Total Distribution". Is this .If you are reporting a total distribution from a plan that includes a distribution of DVECs, you may file a separate Form 1099-R to report the distribution of DVECs. If you do, report the . Your Form 1099-R isn’t going to tell you what portion of that distribution isn’t taxable and if you report the gross distribution, you’ll likely be paying more tax than the law demands. The line 2b shows If the distribution was a total distribution that closed out your account, and it also could be checked to indicate that your financial institution have not .

Instructions for Form 1099-R, Form RRB-1099, and Form RRB-1099-R. Whether you received Form 1099-R or either of the RRB forms, here’s what you should do: Check the . The 1099-R issued for the RMD and under his SSN shows this as a Total Distribution (ie. both boxes in 2b are checked). The RMD distribution shown on the 1099-R was not a total distribution that closed out his account. No, the Taxable amount not determined checkbox is entirely separate from the Total distribution checkbox. Box 2b contains two check boxes that provide information from the payer about the distribution. Taxable amount not determined - The payer was unable to determine the taxable amount, so it's up to the taxpayer to determine it. Total distribution - The entire balance of the account has been distributed.

My 1099-r has a distribution code 2b, but that is not an option in the pull down menu, how do I file that? Codes B and 2 together do not indicate a distribution from a Roth IRA, it instead indicates a distribution from a designated Roth account in a 401(k) or similar qualified retirement plan. There’s a second box in Box 2b: Total Distribution. If you see a checkmark here, then it means that the distribution you received over the tax year effectively closed your account. Box 3: Capital Gain We have a number of clients who are being given 1099R's that have the Line 2b Total Distribution box checked, when in fact they did not receive a "Total Distribution". Is this something that would require an amendment if a "Corrected" 1099R were given?

The 1099-R shows a total distribution of 0 with 8 federal tax withholding and Code-2 "early distribution with the exception" (Box 1 0; Box 2a 0; Box 2b only "Total distribution" marked; ). She deposited the check and another 8 out-of-pocket contribution to her new IRA account AFTER 60 days.

rmd 1099 r total distribution

If you are reporting a total distribution from a plan that includes a distribution of DVECs, you may file a separate Form 1099-R to report the distribution of DVECs. If you do, report the distribution of DVECs in boxes 1 and 2a on the separate Form 1099-R. Your Form 1099-R isn’t going to tell you what portion of that distribution isn’t taxable and if you report the gross distribution, you’ll likely be paying more tax than the law demands. The line 2b shows If the distribution was a total distribution that closed out your account, and it also could be checked to indicate that your financial institution have not determined the taxable amount of the distribution.

The 1099-R issued for the RMD and under his SSN shows this as a Total Distribution (ie. both boxes in 2b are checked). The RMD distribution shown on the 1099-R was not a total distribution that closed out his account. No, the Taxable amount not determined checkbox is entirely separate from the Total distribution checkbox. Box 2b contains two check boxes that provide information from the payer about the distribution. Taxable amount not determined - The payer was unable to determine the taxable amount, so it's up to the taxpayer to determine it. Total distribution - The entire balance of the account has been distributed. My 1099-r has a distribution code 2b, but that is not an option in the pull down menu, how do I file that? Codes B and 2 together do not indicate a distribution from a Roth IRA, it instead indicates a distribution from a designated Roth account in a 401(k) or similar qualified retirement plan.

There’s a second box in Box 2b: Total Distribution. If you see a checkmark here, then it means that the distribution you received over the tax year effectively closed your account. Box 3: Capital Gain We have a number of clients who are being given 1099R's that have the Line 2b Total Distribution box checked, when in fact they did not receive a "Total Distribution". Is this something that would require an amendment if a "Corrected" 1099R were given? The 1099-R shows a total distribution of 0 with 8 federal tax withholding and Code-2 "early distribution with the exception" (Box 1 0; Box 2a 0; Box 2b only "Total distribution" marked; ). She deposited the check and another 8 out-of-pocket contribution to her new IRA account AFTER 60 days.If you are reporting a total distribution from a plan that includes a distribution of DVECs, you may file a separate Form 1099-R to report the distribution of DVECs. If you do, report the distribution of DVECs in boxes 1 and 2a on the separate Form 1099-R.

Your Form 1099-R isn’t going to tell you what portion of that distribution isn’t taxable and if you report the gross distribution, you’ll likely be paying more tax than the law demands.

form 1099 r distribution

form 1099 r check box

form 1099 r box 2b

$2.18

dreyfus why does 1099-r box 2b check total distribution|rmd 1099 r total distribution