is k-1 box 19a distribution taxable We would like to show you a description here but the site won’t allow us. Get more information for Walters Sheet Metal in Leesville, LA. See reviews, map, get the address, and find directions. Advertisement. Advertisement. Search MapQuest. Hotels Food Shopping Coffee Grocery Gas. Walters Sheet Metal +1 (337) 239-4579. site. More. Directions. Advertisement. Advertisement. Photos View gallery.

0 · schedule k 1 explained

1 · schedule k 1 dividends

2 · partnership tax return k 1

3 · ordinary business income k 1

4 · k1 ordinary income vs distributions

5 · k1 distribution tax rate

6 · k 1 income tax rate

7 · are k1 distributions taxable

Closed up the top of the box and have not had any problems for several months until today when the breaker popped again. I heard the "POW" .

If there was profit during the year, then distributions of the profit could be paid out to the members/partners. But, a difference (generally) is that you are not taxed on the value of the distributions you receive, instead you are taxed on your share of the profit/loss of the business.If there was profit during the year, then distributions of the profit could be paid .TurboTax is here to make the tax filing process as easy as possible. We're .From simple to complex taxes, filing is easy with America’s #1 tax prep provider. Get .

We would like to show you a description here but the site won’t allow us.

Contributions of property with a built-in gain or loss could affect a partner's tax liability (in matters concerning precontribution gain or loss, and distributions subject to section 737) and may also .

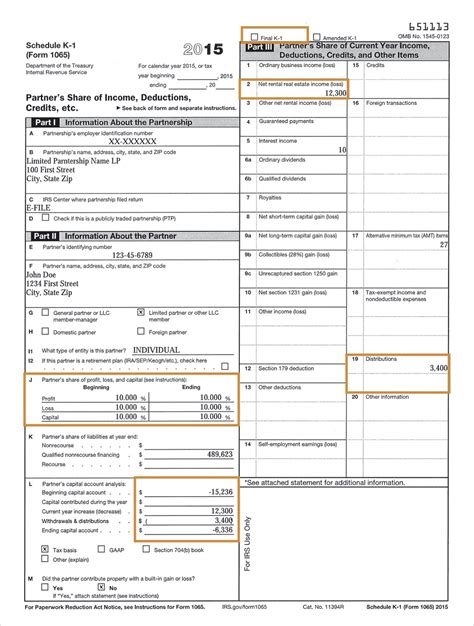

Schedule K-1 for partnerships reports distributions to the partners in box 19A. Since you have to report your share of the partnership income or loss for the tax year whether or not .

The Form 1065 Schedule K-1 shows two types of distributions on line 19. One distribution is shown in the amount of ,000 with the letter “A” in front of it. The second distribution is in the amount of ,000 and has the letter “C” in front of it.Enter the organization's taxable income, if any, on Form 1065, Schedule K, line 6a, and each member's distributive share in box 6a of Schedule K-1 (Form 1065). Net operating losses .

This article will help you enter a Schedule K-1 distribution for box 19, A on a partnership or fiduciary return. For more Schedule K-1 resources, check out our Tax topics . Learn how to report and pay taxes on your share of partnership income, deductions, credits and distributions on Schedule K-1. Find out when withdrawals and distributions are taxable and how to calculate your basis.

Line 19A - Cash & Marketable Securities - The amount reported in Box 19, Code A is the cash and marketable securities distributed in kind to the taxpayer by the partnership. These items reduce the basis that the taxpayer has in the .

The amount of loss and deduction you may claim on your tax return may be less than the amount reported on Schedule K-1. It is the partner's responsibility to consider and apply any applicable . In Turbo Tax, when you enter the distributions from K1s received from other partnerships under K1 section, will the 19a on Form 1065-Schedule K be automatically populated with the sum of all distributions from K1s? Hi, I received a K-1 marked as final and amended and see below numbers. I am little lost on calculating below section since the K-1 is marked as final. Sale price -- not in the K-1 Sale Expense -- not in the K-1 Partnership Basis -- no supporting document in the K-1 to calculate this as well Ord.

Hi, I received a K-1 marked as final and amended and see below numbers. I am little lost on calculating below section since the K-1 is marked as final. Sale price -- not in the K-1 Sale Expense -- not in the K-1 Partnership Basis -- no supporting document in the K-1 to calculate this as well Ord. Hi, I received a K-1 marked as final and amended and see below numbers. I am little lost on calculating below section since the K-1 is marked as final. Sale price -- not in the K-1 Sale Expense -- not in the K-1 Partnership Basis -- no supporting document in the K-1 to calculate this as well Ord. Hi, I received a K-1 marked as final and amended and see below numbers. I am little lost on calculating below section since the K-1 is marked as final. Sale price -- not in the K-1 Sale Expense -- not in the K-1 Partnership Basis -- no supporting document in the K-1 to calculate this as well Ord.

Hi, I received a K-1 marked as final and amended and see below numbers. I am little lost on calculating below section since the K-1 is marked as final. Sale price -- not in the K-1 Sale Expense -- not in the K-1 Partnership Basis -- no supporting document in the K-1 to calculate this as well Ord. Hi, I received a K-1 marked as final and amended and see below numbers. I am little lost on calculating below section since the K-1 is marked as final. Sale price -- not in the K-1 Sale Expense -- not in the K-1 Partnership Basis -- no supporting document in the K-1 to calculate this as well Ord. Hi, I received a K-1 marked as final and amended and see below numbers. I am little lost on calculating below section since the K-1 is marked as final. Sale price -- not in the K-1 Sale Expense -- not in the K-1 Partnership Basis -- no supporting document in the K-1 to calculate this as well Ord. Hi, I received a K-1 marked as final and amended and see below numbers. I am little lost on calculating below section since the K-1 is marked as final. Sale price -- not in the K-1 Sale Expense -- not in the K-1 Partnership Basis -- no supporting document in the K-1 to calculate this as well Ord.

The client received a 1099-B with company stock sale w/o basis and a Sch K-1 showing same amount in the box 19A distribution. Is this amount taxable to the several state K-1s' that came with the Federal K-1 as non-resident Capital Gains income if . Since it appears that you have not maintained your tax basis, we will use the K-1 Part II box L as your tax basis. . Positive ending capital account and final K-1 box 1 not matching distribution in 19A. got it, thanks again for the clarification. I will calculate the numbers accordingly. 8m ago 0 3 Reply. Schedule K-1 is a tax form that a partnership generates to report a partner's share of income, deductions, credits and distributions and other relevant information. Part I of this tax form includes some basic information about the partnership, while Part II has details for the specific partner such as their share of the profit and liabilities plus their identifying details.Schedule E, page 2, column (k) shows nonpassive income of 5,460. The Form 1065 Schedule K-1 shows two types of distributions on line 19. One distribution is shown in the amount of ,000 with the letter “A” in front of it. The second distribution is in the amount of ,000 and has the letter “C” in front of it.

Since it appears that you have not maintained your tax basis, we will use the K-1 Part II box L as your tax basis. You have not indicated whether you have any suspended losses; as you also don't indicate whether you were passive or active in this partnership. . Positive ending capital account and final K-1 box 1 not matching distribution in 19A. Since it appears that you have not maintained your tax basis, we will use the K-1 Part II box L as your tax basis. . Positive ending capital account and final K-1 box 1 not matching distribution in 19A. got it, thanks again for the clarification. I will calculate the numbers accordingly. 4 weeks ago 1 10,315 Reply.

My K-1 Box 5 interest income is and Box 6b qualified dividends is (same in box 6a). My Line 19a distributions is 3. In the instructions, it says for Line 19a: "The partnership paid a cash distribution in December of 2017. . This amount is considered a return of capital reducing your tax basis, and should not be reported as income .

Since it appears that you have not maintained your tax basis, we will use the K-1 Part II box L as your tax basis. . Positive ending capital account and final K-1 box 1 not matching distribution in 19A. got it, thanks again for the clarification. I will calculate the numbers accordingly. Monday 1 1,570 Reply.Greetings, Schedule K-1 for partnerships reports distributions to the partners in box 19A. Since you have to report your share of the partnership income or loss for the tax year whether or not the income is distributed to you in the same year, the amount of your distribution is not usually reported on your tax return for the year it is distributed. Hi, I received a K-1 marked as final and amended and see below numbers. I am little lost on calculating below section since the K-1 is marked as final. Sale price -- not in the K-1 Sale Expense -- not in the K-1 Partnership Basis -- no supporting document in the K-1 to calculate this as well Ord. See separately the questions about "stock/stock options" versus your mention of a Form 1065 K-1. To report the long-term gain for a distribution in excess of basis (distribution up to your basis is not taxable), click the "magnifying glass Search" icon on the top row, enter "investment sales" in the search window and press return or enter, and then click on the .

The partnership will determine the gain, report the gain on the partnership return and the K-1's. Keep in mind that some of the gain may need to be reported as unrecaptured section 1250 gain. The distribution is just reported as any other distribution; Schedule K-1 . Hi, I received a K-1 marked as final and amended and see below numbers. I am little lost on calculating below section since the K-1 is marked as final. Sale price -- not in the K-1 Sale Expense -- not in the K-1 Partnership Basis -- no supporting document in the K-1 to calculate this as well Ord. The remaining distributions of "principal only" are made to the 5 beneficiaries (Children of the Decedent Trust) are such non-taxable distributions reportable on the K-1 in Box 14? The Trust has been distributing amounts annually to the beneficiaries of principal only and have never reported such distributions in the tax return.

Hi, I received a K-1 marked as final and amended and see below numbers. I am little lost on calculating below section since the K-1 is marked as final. Sale price -- not in the K-1 Sale Expense -- not in the K-1 Partnership Basis -- no supporting document in the K-1 to calculate this as well Ord. Hi, I received a K-1 marked as final and amended and see below numbers. I am little lost on calculating below section since the K-1 is marked as final. Sale price -- not in the K-1 Sale Expense -- not in the K-1 Partnership Basis -- no supporting document in the K-1 to calculate this as well Ord.

Hi, I received a K-1 marked as final and amended and see below numbers. I am little lost on calculating below section since the K-1 is marked as final. Sale price -- not in the K-1 Sale Expense -- not in the K-1 Partnership Basis -- no supporting document in the K-1 to calculate this as well Ord. Hi, I received a K-1 marked as final and amended and see below numbers. I am little lost on calculating below section since the K-1 is marked as final. Sale price -- not in the K-1 Sale Expense -- not in the K-1 Partnership Basis -- no supporting document in the K-1 to calculate this as well Ord.

Hi, I received a K-1 marked as final and amended and see below numbers. I am little lost on calculating below section since the K-1 is marked as final. Sale price -- not in the K-1 Sale Expense -- not in the K-1 Partnership Basis -- no supporting document in the K-1 to calculate this as well Ord.

china aluminum sheet metal fabrication supplier

$14.19

is k-1 box 19a distribution taxable|k 1 income tax rate