1099 r box 7 distribution code 7d May 18, 2023 7:46 AM TurboTax is here to make the tax filing process as easy as . Source over 17411 cnc machined parts for sale from manufacturers with factory direct prices, high quality & fast shipping.

0 · irs distribution code 7 meaning

1 · irs code 7d on 1099

2 · irs 1099 box 7 codes

3 · form 1099 r box 7

4 · distribution code 7 normal

5 · 1099 r distribution code meanings

6 · 1099 r code 7 taxable

7 · 1099 form distribution code 7

Explore & source all the CNC replacement parts you need to keep your machine in top working order. Connect with us if you need help finding the correct part.

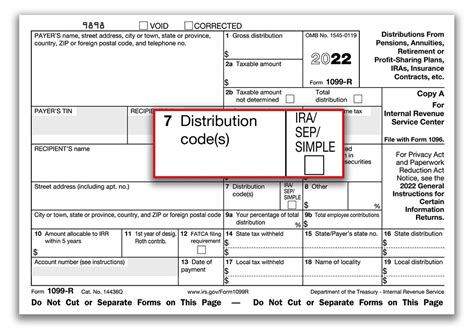

Box 7 is used to report income to you. The different codes within box 7 tell what the tax treatment of any distribution amounts should be. 7 is the code for Normal Distribution (which means it was distributed to taxpayer after age 59.5). D is the new 'nonqualified annuity .Box 7 is used to report income to you. The different codes within box 7 tell what the .May 18, 2023 7:46 AM TurboTax is here to make the tax filing process as easy as .About form 1099-NEC; Crypto taxes; About form 1099-K; Small business taxes; .

We would like to show you a description here but the site won’t allow us.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .

1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here.

Distributions to a domestic abuse victim. For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403 (b) plan and is not subject to . Use Code D for a distribution from any plan or arrangement not described in sections 401 (a), 403 (a), 403 (b), 408, 408A, or 457 (b). See Distributions under Employee Plans .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code(s) found in Box 7, .

The different codes within box 7 tell what the tax treatment of any distribution amounts should be. 7 is the code for Normal Distribution (which means it was distributed to taxpayer after age 59.5). D is the new 'nonqualified annuity distribution code'.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here.For a distribution of contributions plus earnings from an IRA before the due date of the return under section 408(d)(4), report the gross distribution in box 1, only the earnings in box 2a, and enter Code 8 or P, whichever is applicable, in box 7.Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401 (k), or section 403 (b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for repo.

irs distribution code 7 meaning

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. 7 (Normal Distribution) B (Designated Roth) Code P: Corrective refunds taxable in prior year: This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) B .

The different codes within box 7 tell what the tax treatment of any distribution amounts should be. 7 is the code for Normal Distribution (which means it was distributed to taxpayer after age 59.5). D is the new 'nonqualified annuity distribution code'.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.1099-R. Report military retirement pay awarded as a property settlement to a former spouse under the name and TIN of the recipient, not that of the military retiree. Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here.For a distribution of contributions plus earnings from an IRA before the due date of the return under section 408(d)(4), report the gross distribution in box 1, only the earnings in box 2a, and enter Code 8 or P, whichever is applicable, in box 7.

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401 (k), or section 403 (b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for repo.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.

irs code 7d on 1099

$149.43

1099 r box 7 distribution code 7d|irs code 7d on 1099